There are several online resources where you can find tables or charts that provide information on solar tax exemptions by state. Here are a few options:

- Database of State Incentives for Renewables & Efficiency (DSIRE): DSIRE is a comprehensive database of state and federal incentives and policies related to renewable energy and energy efficiency. It provides a detailed breakdown of each state’s solar tax exemptions and incentives, including property tax exemptions, sales tax exemptions, and income tax credits.

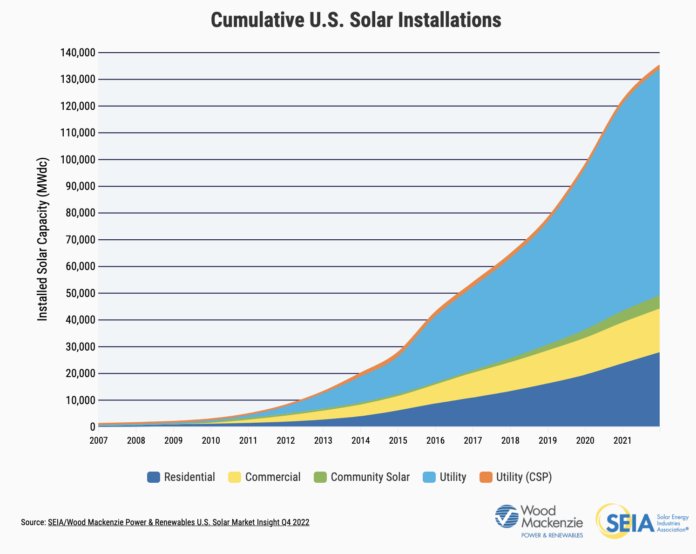

- The Solar Energy Industries Association (SEIA): SEIA is a national trade association for the solar energy industry. Their website provides information on the different types of solar incentives and policies by state, including tax exemptions.

- EnergySage: EnergySage is an online solar marketplace that provides information on the costs and benefits of going solar. They have a section on the website that summarizes solar incentives by state, including tax exemptions.

- National Renewable Energy Laboratory (NREL): NREL is a national laboratory that conducts research and development on renewable energy. Their website provides a state-by-state breakdown of solar incentives, including tax exemptions and rebates.

It’s worth noting that the information these resources provide can change over time and may vary depending on the state and the type of property or business. It’s always recommended to check with your state government website or a solar energy professional to get the most up-to-date information and determine the specific tax exemptions and incentives available in your area.